Dr Walter Beckert’s research examines patient choice and competition in healthcare. He reflects on the future of the NHS and the Tory Leadership candidates’ proposals to secure it.

The NHS is an almost universally revered institution in the UK. It is built on principles of social justice and equity, and arguably it embodies the nation’s social conscience.

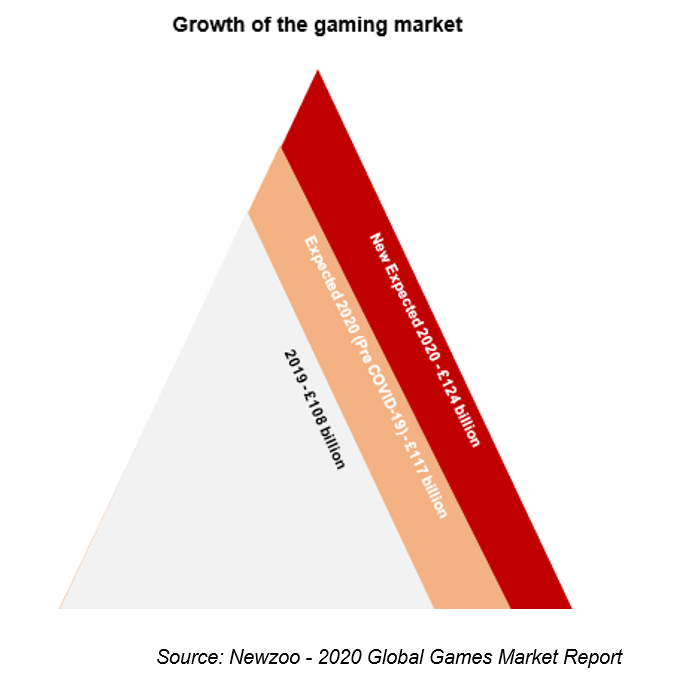

But as the constraints under which the UK as a society and economy operates dynamically evolve — reflecting years of austerity, Brexit, the COVID pandemic, the cost-of-living crisis –, so do our experiences with the NHS, as a healthcare provider, as a system preventing people from poverty due to ill health, and as our collective capacity to care. It is difficult to make GP appointments, patients face long waiting lists for many elective and also urgent procedures, A&E units are often overwhelmed, and the system exhibits outcomes that are middling relative to health systems of similarly developed countries. There is also recent evidence of an accelerated drive of patients toward self-funding some of their medical treatments, as a means of bypassing the constraints in the system. The system’s public funding (10.2% of GDP in 2019) lags behind the levels seen in countries like France (11.1% of GDP in 2019) and Germany (11.7% of GDP in 2019), with austerity leading to cumulative underinvestment in the NHS and social care over decades.

This raises the question of whether this system in its current form is fit for purpose, constitutes value-for-money, and how it could gainfully be adapted and improved.

One avenue of ongoing gradual change has been the marketization of the system. That process introduced competition between NHS providers and also with private providers. It also decentralized the system, devolving budgetary and organisational powers to the local level. And it introduced an element of mixed public – private funding. Research (Beckert and Kelly, Health Economics, 2021) shows that publicly funded patients may benefit from privately provided capacity, albeit often in a less than equitable manner.

Mixed systems exist elsewhere, e.g. Australia and the Netherlands. And along some metrics their outcomes tend to outperform the NHS’s outcomes. However, the pre-pandemic performance within different funding models was more varied than performance across the models. The funding model itself is not the issue. What matters is the organisation of the system and the level of funding.

The contenders for the Tory leadership — and hence the next Prime Minister – so far have barely touched the NHS crisis, notwithstanding calls for an honest assessment by the head of the NHS Confederation and others, let alone have they advanced any concrete proposals for change that go beyond opaque elimination of bureaucracy. Liz Truss’s apparent commitment to reverse the recent National Insurance rise, intended to bolster the system’s funding position, appears to even aggravate the funding constraints.

But funding is just one element of a necessary national discussion of what we do and reasonably can expect from a healthcare system. Healthcare systems only affect around 20% of our own health: The rest is due to a wider determinant set of health, including social determinants such as the level of poverty, unemployment, stress, etc. Short-term focussed policy debates typically offer headline grabbing quick fixes. They fail to acknowledge that healthcare – like education – is a long-term investment in health, the economy, and broader societal welfare.