This blog was contributed by BSc Financial Economics student Paul Talbot and was originally written as an assignment for the module Quantitative Techniques for Applied Economics.

Classic cars, an alternative investment that is rarely discussed when investors are looking for a strategy to increase ROI in their portfolios. Some prestige classic cars have increased over 400% in the last decade[1], but what sets these assets apart from status quo investing?

“Stories. That to me is the answer. Every car has its own history, its own adventures, its own japes and probably plenty of scrapes. Tales to be told and shared with fellow enthusiasts. Few other asset classes, however valuable or beautiful, can match it”[2]

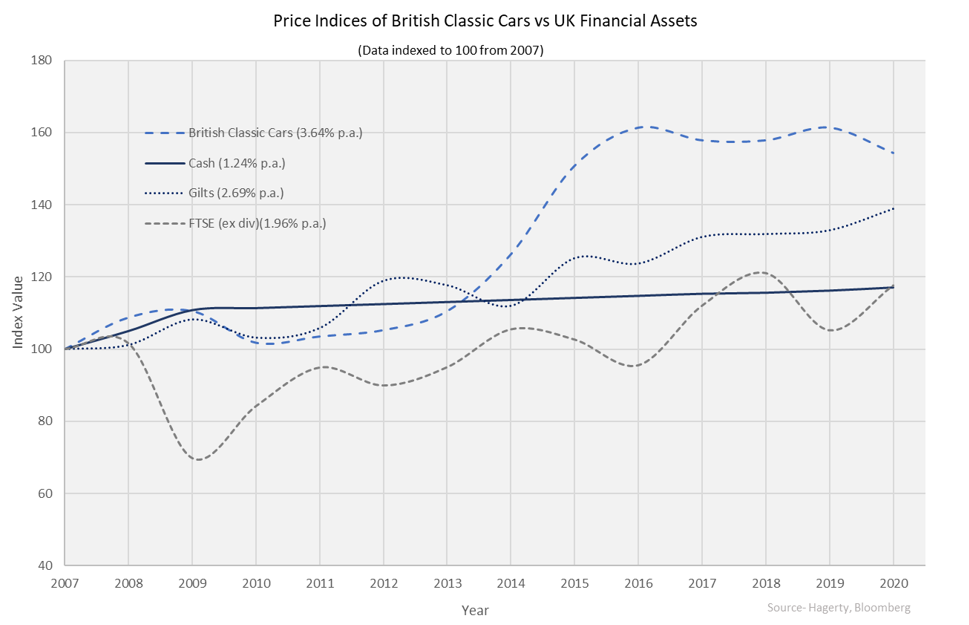

The majority of investors would not be able to afford a 1960 Ferrari 250 GT, but investment growth has been seen across the majority of the classic car market. A more affordable sector is British classic cars, iconic cars such as the Jaguar E-Type or the Triumph TR6 has yielded over 50% returns since 2007, outpacing the heavyweight UK asset classes.

The classic car market also benefits from a favourable tax status, investors do not pay capital gains tax on profits as they are classed as “Wasting Assets” by HRMC. Movable assets such as classic cars can be gifted to family members, if no benefit is retained or lent, or for a period each year, to a car museum to avoid paying inheritance tax on death. If you intend to enjoy your investment on the road, they are also exempt from road tax and a MOT.

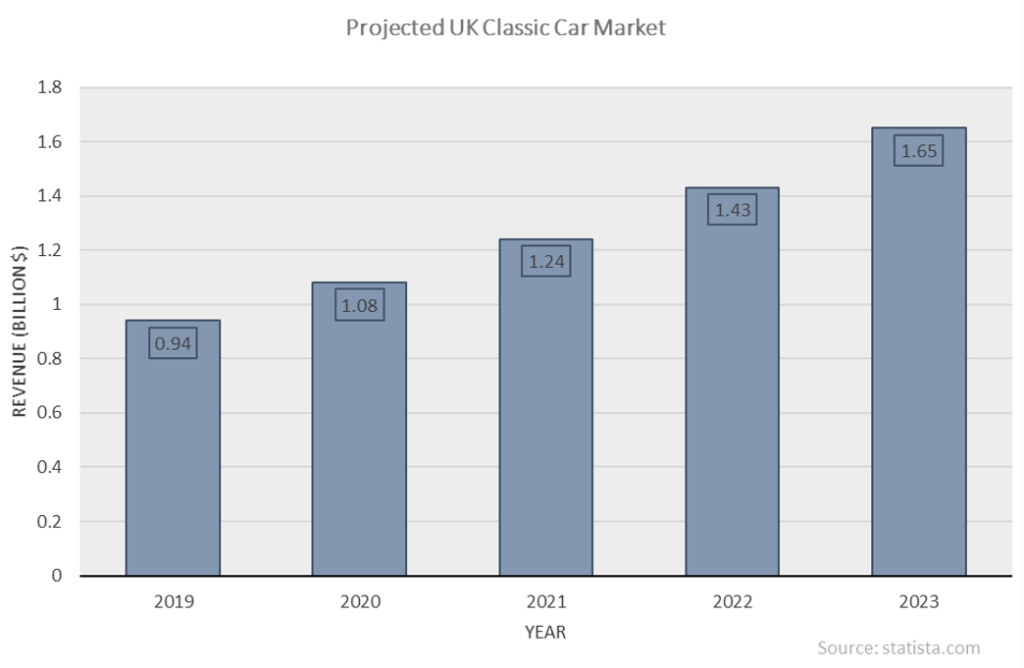

Tax relief of 20% on investment gains already drives these assets ahead of other financial instruments and it is no surprise that this is attracting some attention. The classic car market added significant gains to the UK economy last year[3] and is expected to continue grow from £940 Million in 2019 to £1.65 Billion in 2023.

Investing in classic cars does not come without a few speed bumps, it is not a case of purchasing any car and hiding it away for many years. Paul Michaels of Hexagon Classics notes “The very best cars — meaning those with full histories in exceptional condition, either completely restored or lovingly maintained with some age-related patina — will always command the highest prices.”

It is always advisable to get an expert opinion and the history authenticated before purchasing your investment and continue to keep your new asset lovingly maintained and stored away from the elements. All the above will add an upfront and annual running cost to purchasing the investment, reducing overall yield, but in turn, the better the asset is maintained and stored, the higher possibility of future gains.

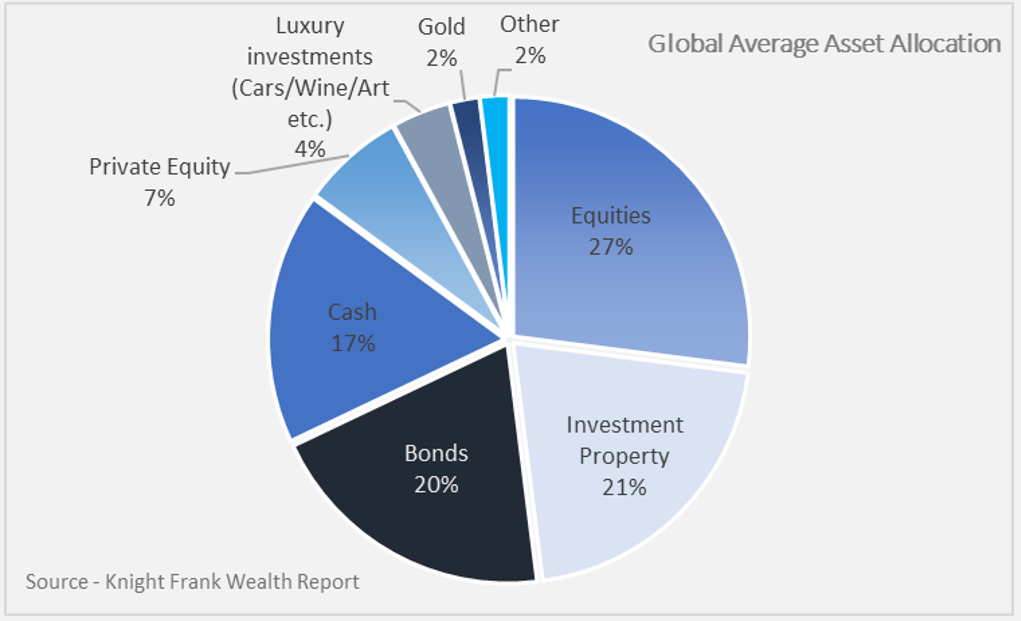

The average global investment portfolio last year contained only 4% of luxury investments, this includes fine wines, collectable coins, art, jewellery and classic cars to name a few[4]. With climate change at the forefront of government polices banning the sale of petrol/diesel cars by 2030 and the rise of autonomous vehicles, will only make these investment stars a rarer commodity.

With central banks flooding the markets with liquidity, artificially supporting equities and driving down bond yields, parking a little piece of history in your garage and diversifying your portfolio will not only provide the perfect inflation and market correction hedge, but you may have some fun along the way.

Next time you look at your annual investment report, the immortal words of Wilbur Shaw may spring to mind.

“Gentleman, start your engines”

Further Information

[1] https://www.hagerty.com/apps/valuationtools/market-trends/collector-indexes/Ferrari

[2] HRH Prince Michael of Kent interview with Knight Frank November 2020

[3] FBHVC National Historic Vehicle Survey – https://www.britishmotorvehicles.com/news/fbhvc-national-historic-vehicle-survey-reveals-significant-contribution-to-uk-economy

[4]The Attitudes Survey is based on responses from 600 private bankers and wealth advisers managing

over US$3 trillion of wealth for UHNWI clients. The survey was taken during October and November 2018