This article was written by Dr Federica Rossi from Birkbeck’s Department of Management and Professor Aldo Geuna from the University of Torino

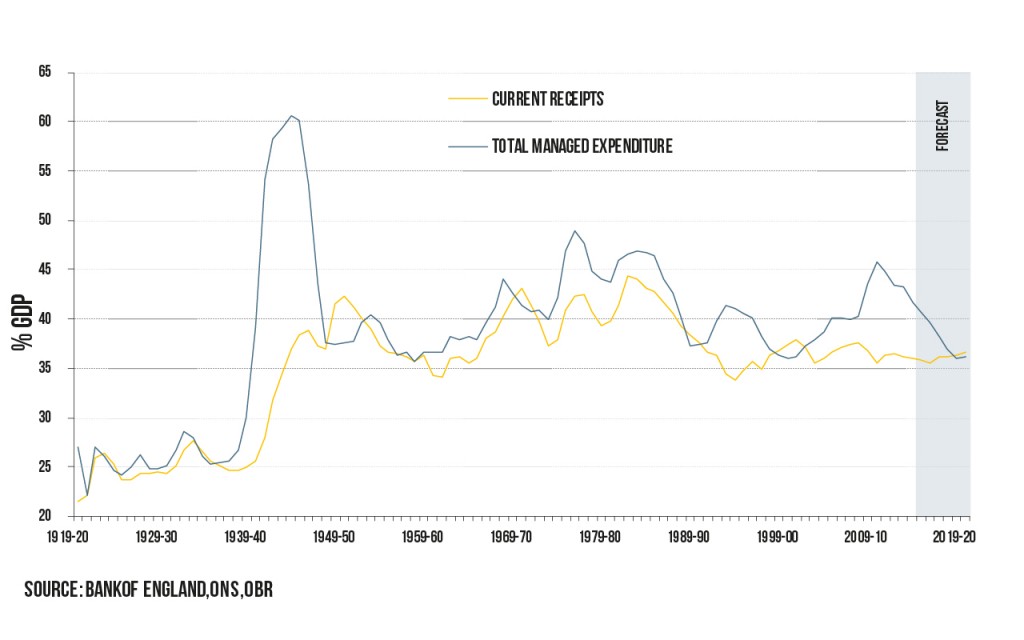

The last few decades have witnessed the increasing privatisation of the public sphere – even in the realms of education and research, which, until recently, almost exclusively pertained to the public sector. Evidence from Organisation for Economic Co-operation and Development (OECD) countries shows that the slow but steady increase in private sector Research & Development (R&D) expenditure as share of GDP has been accompanied by a parallel drop in public R&D expenditure since the 1980s. A mere handful of economies buck the trend, such as that of South Korea. This has recently been referred to by Birkbeck’s Professor Daniele Archibugi and Dr Andrea Filippetti in their new paper as the “retreat of public research”. In the most advanced economies this retreat might seem, at face value, to support the claim that public intervention in research is unnecessary, if not completely counterproductive to sustain technological progress.

The last few decades have witnessed the increasing privatisation of the public sphere – even in the realms of education and research, which, until recently, almost exclusively pertained to the public sector. Evidence from Organisation for Economic Co-operation and Development (OECD) countries shows that the slow but steady increase in private sector Research & Development (R&D) expenditure as share of GDP has been accompanied by a parallel drop in public R&D expenditure since the 1980s. A mere handful of economies buck the trend, such as that of South Korea. This has recently been referred to by Birkbeck’s Professor Daniele Archibugi and Dr Andrea Filippetti in their new paper as the “retreat of public research”. In the most advanced economies this retreat might seem, at face value, to support the claim that public intervention in research is unnecessary, if not completely counterproductive to sustain technological progress.

Most economists agree that public research funding is crucial for economic growth…

The mainstream view that public funding of basic research is necessary for technological progress to occur, relies on two, intertwined arguments that were first put forward in the 1940s and 1950s, and have been reiterated in various forms ever since. The first is the argument, which is embraced by scientists but originated in management schools, that innovation is a linear process whereby basic research discoveries pave the way for subsequent applied research and technological development. The second is the argument put forward by economists that basic research is characterised by large externalities and extreme uncertainty in the timing and nature of its outcomes, which make the computation of returns extremely difficult and discourages private companies from investing. Basic research outcomes tend to be very abstract and codifiable; this vulnerability to copying further discourages private investment in their production.

Together, these arguments suggest that, in order to sustain a rate of technological progress that is sufficient to drive continuous growth, the economy needs to produce a continuous amount of basic research outcomes, which would not occur in the absence of public funding.

…but some think that public research funding is unnecessary…

Those calling for a reduction in government funding of science have, in turn, put forth several arguments to oppose the mainstream view. The first is that the linear model of innovation is not only too simplistic, but wrongly organised: throughout history, technological developments have more often than not originated from efforts to solve practical problems without prior scientific basis. Rather than underpinning technological development, basic research has a habit of following promising technological developments. As Matt Ridley interprets in a recent article on the Wall Street Journal: “The steam engine owed almost nothing to the science of thermodynamics, but the science of thermodynamics owed almost everything to the steam engine.” The second is that basic research effectively crowds out private funding. In the absence of public funding, private companies would still invest in basic research to further consolidate their knowledge of how previously invented technologies actually work, which assists further innovation, and would want to do so in-house, rather than free ride on competitors’ basic research outcomes, to generate tacit knowledge which would give them a competitive advantage over rivals. Indeed, free from the crowding-out effect of public funding, private companies might have invested in basic research, which may have yielded more productive outcomes than the basic research funded by government.

…The middle ground: public research funding for the knowledge economy

As is the case for most complex social phenomena, the nature of technological progress is probably best understood by combining different theoretical perspectives. Suggesting that all technological developments would have occurred in the absence of prior scientific knowledge is just as simplistic as the opposing argument – that basic research is always the first step of a linear innovation process. While the rich history of technology can be mined for examples of each of these extremes, most innovations tell a complex story of coevolution between basic research and technological development, where both private and public research funding play a role. For example, Dosi and Nelson (2010) have suggested that, while the development of the steam engine in the early 18th century preceded scientific developments in thermodynamics and the theory of heat, this technology was indeed built on the foundations of earlier scientific developments (the understanding of the properties of atmospheric pressure investigated by Torricelli, Boyle and Hooke in the 17th and 18th century). This coevolution between science and technology would explain why the steam engine was not invented in China, where all its components (pistons, cylinders, etc,) were known and employed.

Basic science and technological development coevolve, and the problem begins to look like the chicken and egg situation. Nonetheless, there are several compelling reasons for continued public funding of basic research. On the one hand, private companies in the main cannot commit to continued funding of a research programme in the long or even medium term; not only because they tend to respond to short term investor concerns, but also because their very survival is not guaranteed. Even if some companies committed to keep their lines of inquiry open in the absence of early promising research outcomes (something which few companies appear willing to do) there is no guarantee that that programme would not be destroyed by business failure – an increasingly frequent and rapid occurrence even in larger corporations. Public funding provides a buffer to research exploration, which opens up to society a range of research avenues that simply would not occur in its absence, and whose results may be reaped many decades later, benefitting the economy in unexpected ways. Sometimes, basic research is so distant in time and origins from the innovations it contributes to, that such contribution goes unnoticed; current developments in text mining and even speech recognition technology owe a huge debt to many decades of obscure publicly funded research carried out in linguistics departments but this contribution is hardly something that springs to mind when thinking of Siri or Alexa bots. On the other hand, as Archibugi and Filippetti point out, private companies and governments have different incentives in the dissemination of research outcomes: private companies as a rule will give away as little as possible or will only give away knowledge under certain conditions, which again limits the range of research avenues that can be explored starting from existing research.

What the knowledge economy needs is a functioning ecosystem where both public and private research contribute to the creation of new knowledge, its dissemination and commercial exploitation, and create the conditions for further knowledge production. The better interconnected the two spheres, the better the system can promote an efficient division of labour between privately funded and publicly funded research, and the better it can discourage the duplication of research effort. Moreover, the better it can ensure that knowledge can be freely disseminated as much as possible without hurting commercial interests. The economic impact of the “retreat of public research” might not be negative if it has been accompanied by the growth of a more interconnected research system in which public research has become a more efficient complement to private research. However, this is a rather unexplored hypothesis at the macro level – and even if this were the case, it would still not imply that the latter can replace the former. Public research continues to play a vital role in the knowledge economy.

Professor Aldo Geuna and Dr Federica Rossi are the authors of The University and the Economy Pathways to Growth and Economic Development Cheltenham: Edward Elgar (2015). Now available in paperback.