This post was contributed by Charles Shaw, 4th year BSc Financial Economics student, and member of the Birkbeck Economics & Finance Society

On the 8th of July, the Chancellor of the Exchequer will announce his summer budget, and with it the next stage of cuts.

On the 8th of July, the Chancellor of the Exchequer will announce his summer budget, and with it the next stage of cuts.

The latest official estimates indicate that the Government will announce an additional £30bn of austerity measures, with substantive cuts in FY 2016 and 2017, to stabilise in 2018 and rebound in 2019. Although the impact of such cuts will largely depend on how they are allocated across UK Government departments, the Chancellor has already signalled that £12bn of these cuts will come from welfare spending.

This should, if delivered, be sufficient to meet the George Osborne’s own key fiscal targets i.e. to have debt falling as a share of GDP in 2016-17 and to achieve a cyclically adjusted current balance in 2018-19 without having to resort to tax rises.

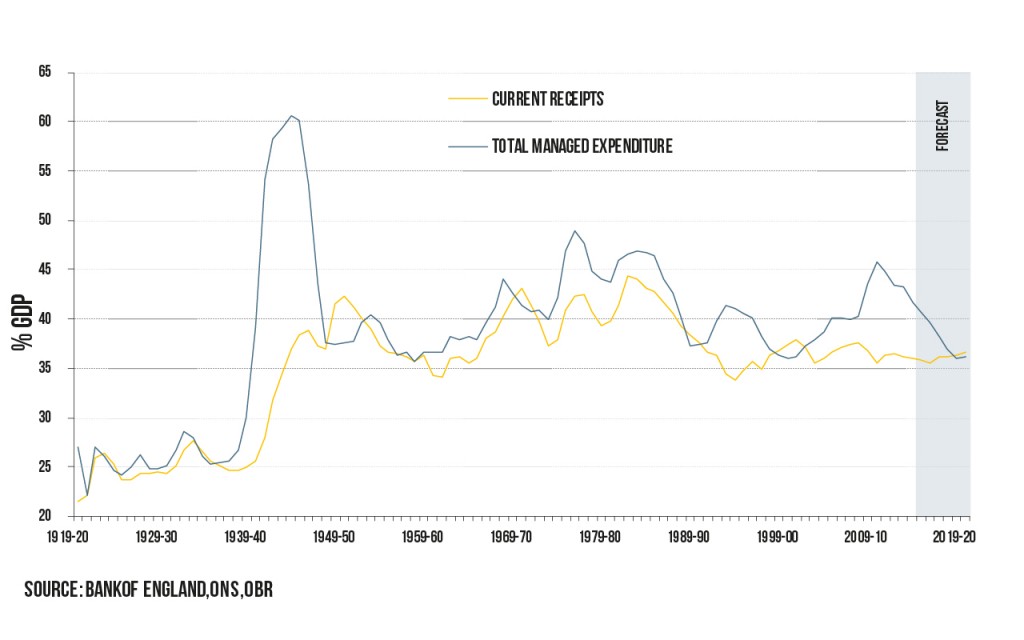

This trenchant commitment to eliminate the deficit by the end of the decade echoes the pledges made in the Conservative Party manifesto, which set out to “balance the books” and to have “the government taking in more than it is spending for the first time in 18 years.”

UK recovery

This is an ambitious task, considering other manifesto-related spending commitments, such as the doubling of the free childcare allowance, Dilnot reforms, extension of income tax breaks for those on minimum wage, and a freeze on VAT, income tax and NI contributions. An additional constraint is the subdued nature of the UK recovery, which so far has meant that growth in tax receipts has been slower than the UK Government anticipated when it set out its fiscal consolidation plans in 2010.

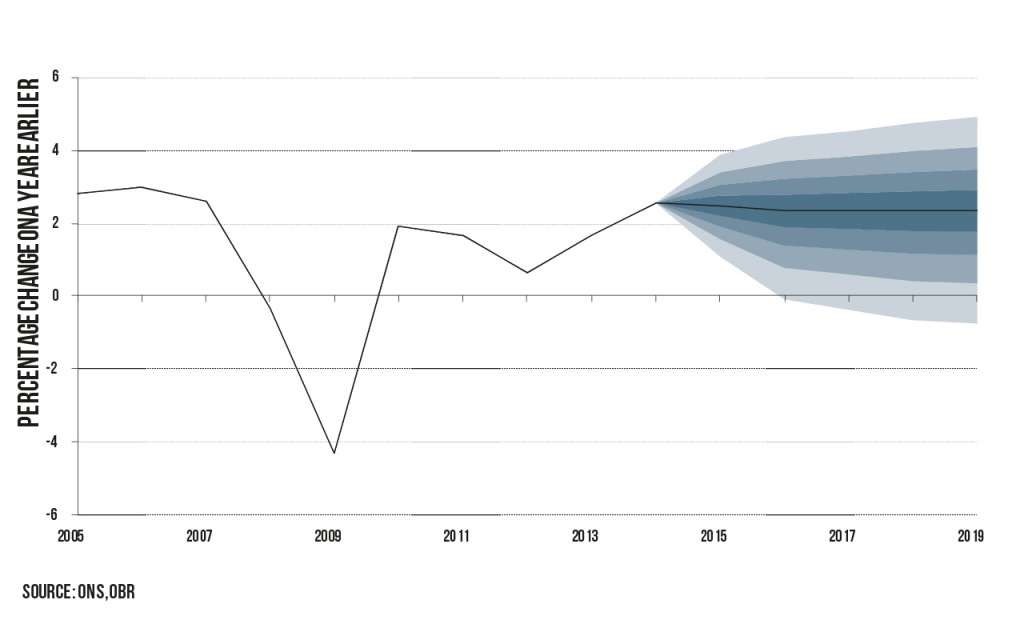

The current macroeconomic outlook is seemingly benign. Aggressive monetary policy has done its job of stimulating demand in the UK and, as tail risks fade, we can continue to expect growth around 2.5% at low inflation, supported by strong tailwinds of cheap oil and weak euro.

The situation in Europe

At the same time, the Chancellor must be keenly aware of the situation – both economic and political – in Europe. Despite the fact that relations between the United Kingdom, the EU and the City of London have become more fraught since 2008, much of the EU’s economic agenda overlaps with United Kingdom’s. What happens in Europe is and will continue to be vitally important to Britain’s economic interests.

We may bear witness to the fact that the moderate recovery in the Eurozone is ongoing, buoyed by the OMT programme, while QE, oil and the euro should continue to add momentum. The latest macroeconomic projections from the staff at the Eurosystem – the monetary authority that is made up of the ECB and the national central banks of the EU Member States whose currency is the euro – indicate that the euro area will see its annual real GDP increase by 1.5% in 2015, 1.9% in 2016 and 2.0% in 2017.

The global economy

So far so good? Not quite. Perhaps economists are by nature pessimistic, but one cannot escape from the fact that recent growth numbers for the global economy have been disappointing. The details of the growth figures should give pause for thought, too. Lost trend output is not regained, not least in developed economies; growth dynamics, in emerging markets and elsewhere, have dampened; ECB could have done much more to stabilise confidence and demand.

The fact that the UK has seen its growth rate shrink does not augur well for prospects of a full recovery. To make matters worse, it has become patently obvious that the lower crude price is less of a driving force for the global economy than had been previously anticipated. Perhaps, against this background of disappointment, the optimists should start to wonder whether a slowdown is under way.

Critics of the Chancellor’s plans say that the scale of the spending cuts set out in the previous Budget significantly exceeds what is required to meet the UK Government’s own fiscal targets. We shall need to wait and see if the summer budget heralds the return of animal spirits.

Find out more

About EFS: Birkbeck Economics & Finance Society promotes informed discussion of economic questions. We aim to be a source of educational and networking opportunities by providing access to high calibre speakers, industry intelligence and leading edge ideas. To become a member, to view the full list of events or to register for a talk please visit our society website at www.BirkbeckEFS.org